CA SI-550 2020-2025 free printable template

Get, Create, Make and Sign si 550 form

Editing form si 550 california printable online

CA SI-550 Form Versions

How to fill out si 550 form download

How to fill out CA SI-550

Who needs CA SI-550?

Video instructions and help with filling out and completing si 550 form state of california

Instructions and Help about statement of information california si 550

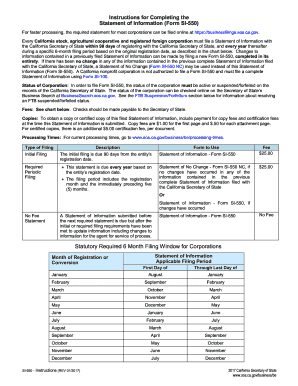

The following information is provided for educational purposes only and in no way constitutes legal, tax or financial advice. For legal, tax or financial advice specific to your business needs, we encourage you to consult with a licensed attorney and/or CPA in your state. The following information is copyright protected. No part of this lesson may be redistributed, copied, modified or adapted without prior written consent of the author. Before beginning this Lesson, please make sure that you have your stamped and approved Articles of Organization back from the State. Otherwise, you will not have the information you need to prepare the next document. As we discussed in Lesson 2, California has a number of additional requirements for your LLC to remain in compliance with the State. The first of these requirements is called the Statement of Information. The purpose of the Statement of Information is to keep the State updated with your LLC's contact information. It includes your LLC Name, your Secretary of State File Number, the LLC's Address, the Names and Addresses of the Member or Members, your Registered Agent information, as well as a brief description of your business. You can find your Secretary of State File Number on your stamped and approved Articles of Organization that you received back from the State. You will need to file your first Statement of Information within 90 days of the approval of your LLC. Then you will need to file it again every two years. It will be due by the anniversary date of the approval of your LLC. The anniversary date is the date the Articles of Organization was stamped and approved by the State. The fee for filing your initial Statement of Information is just $20. In two years, when you file again, the cost will remain the same at $20. Failure to file on time, whether it's the initial or the ongoing Statements of Information, will result in the State charging a late fee of $250, and they may eventually dissolve or shut down your LLC. Here are some examples of deadlines. Let's say the Approval Date of your LLC was February 15th in 2015. Your initial or the first Statement of Information would be due by May 16th of the same year. That's within 90 days of the Approval Date. Then your next Statement of Information is going to be due February 15th of the year 2017. This is two years after the Approval Date. Then your ongoing Statements of Information will be due every two years by the February 15th deadline. Let's look at one more example because I know hearing this all at once right away can sometimes be a little confusing. So let's look at Example 2. Let's say the Approval Date of your LLC was October 1st in 2015, and you may be watching these videos in the future, so these dates are just arbitrary just to help paint an example to make it a little more clear. Again, if the Approval Date of your LLC is October 1st, 2015, your initial Statement of Information is going to be due before December 30th of 2015. Again,...

People Also Ask about bizfile sos ca gov form si 550

Who needs to file SI-550?

Why do I need to file form SI-550?

How often do you have to file SOI?

How often do you need to file form SI-550?

Do I have to file form SI-550?

What is form SI-550 Secretary of State?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ca statement of information form si 550 directly from Gmail?

How can I send ca gov form si 550 for eSignature?

How can I get california si statement information corporations form?

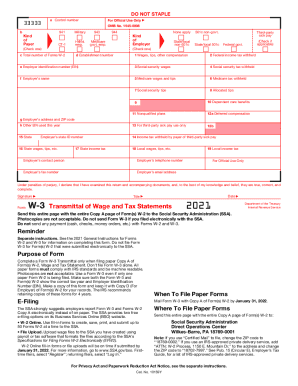

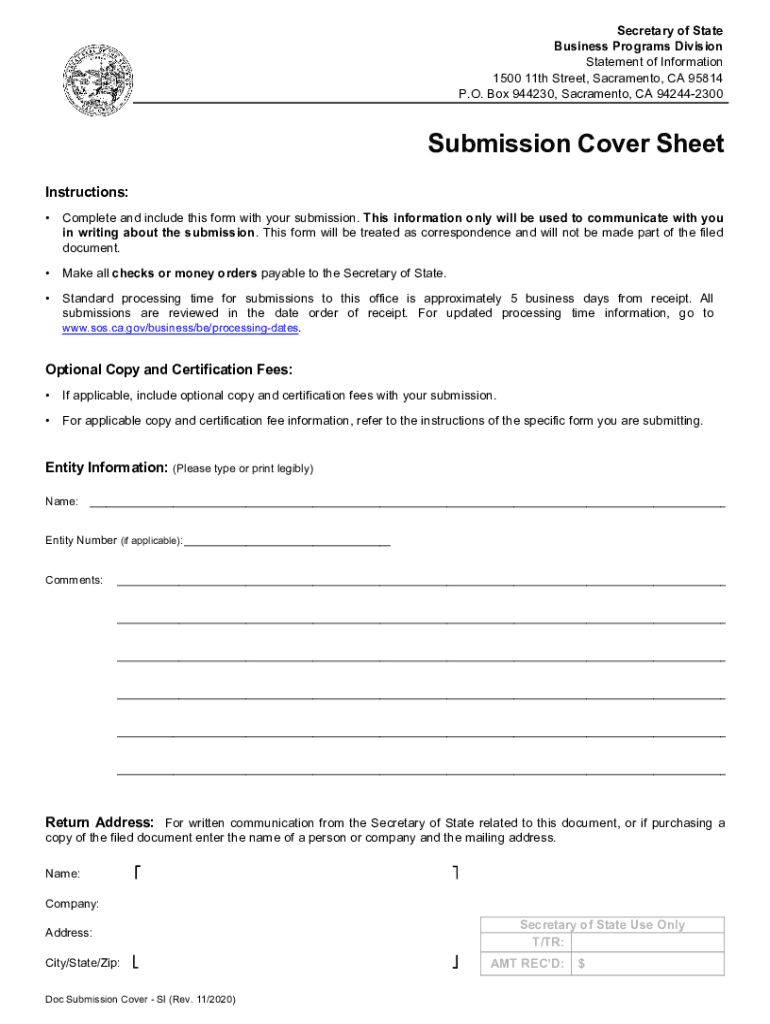

What is CA SI-550?

Who is required to file CA SI-550?

How to fill out CA SI-550?

What is the purpose of CA SI-550?

What information must be reported on CA SI-550?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.